The Reinsurance Directive, 2023 (first amended in 2025), issued by the Nepal Insurance Authority (NIA), is an important step toward creating a more transparent, risk-based, and technically strong reinsurance system in Nepal. This directive was introduced under Section 166 of the Insurance Act, 2022, with the aim of making reinsurance practices more modern and effective.

It focuses on using Nepal’s own reinsurance capacity first, while also allowing partnerships with trusted international reinsurers when needed. By setting clear rules and standards, it helps reduce risks, improve financial security, and build trust in the insurance market.

Another important feature of this directive is that it opens doors for foreign insurers and investors to participate in Nepal’s reinsurance market under certain rules. This creates opportunities for global expertise, advanced technology, and more investment in Nepal’s insurance sector, while still protecting the interests of domestic insurers.

In this article, we will look at the main points of the directive, including its structure, technical requirements, and what it means for life and non-life insurance companies operating in Nepal.

Foundation and Framework: Definitions and Scope

The directive sets a comprehensive terminological base under Section 2, covering key concepts such as:

- Facultative vs. Treaty Reinsurance

- Net Retention vs. Cession

- Retrocession, Cover Note, and Reinsurance Slip

These definitions clarify the regulatory vocabulary and ensure uniform understanding among insurers, reinsurers, brokers, and regulators.

Why This Directive Is Important?

- To ensure the financial strength and stability of Nepali insurers.

- To prevent excessive dependence on foreign markets for reinsurance.

- To promote and strengthen domestic reinsurers like Nepal Re.

- To protect the interests of policyholders, especially during major disasters.

- To attract reputed and financially strong foreign reinsurers, which helps share large risks, bring in global expertise, and ensure timely claim settlements.

Reinsurance Obligations of Insurers

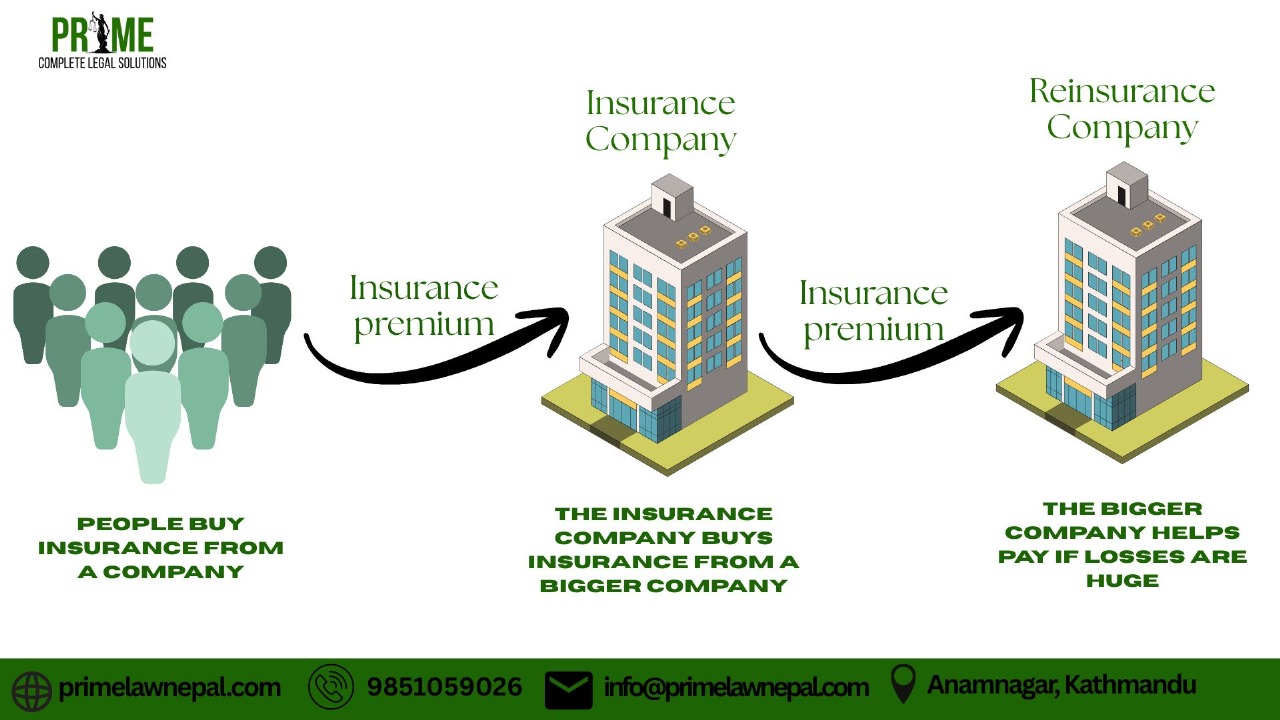

Reinsurance is like insurance for insurance companies. When an insurer feels a risk is too big to handle alone (for example, insuring an airplane or a large building), it shares that risk with another company a reinsurer. That way, if something bad happens, the reinsurer will also help pay the claim.

There are three common types: section 3

- Treaty Reinsurance

- Facultative Reinsurance

- Insurance pool

Preference to Domestic Reinsurers

The Insurer Reinsurance Directive, 2080, gives priority to domestic reinsurers to strengthen Nepal’s reinsurance market. The rules differentiate between Facultative Reinsurance and Treaty Reinsurance, setting specific conditions for both.

1. Facultative Reinsurance

Under facultative arrangements, insurers are required to first offer the risk to domestic reinsurers. Only when domestic reinsurers decline the offer can insurers approach foreign reinsurers.

This ensures that local reinsurance companies get the first opportunity to accept business, thus keeping reinsurance premiums within the country.

Key Points:

- Insurers must first approach domestic reinsurers.

- Foreign reinsurers can be approached only if locals refuse.

- Supports the growth and capacity of the domestic reinsurance sector.

2. Treaty Reinsurance

For treaty arrangements, insurers must retain at least 30% of the remaining cession with domestic reinsurers after fulfilling the direct cession requirement.

Additionally, the Directive lists certain insurance categories that domestic reinsurers cannot refuse.

Domestic reinsurers must accept:

- Life insurance

- Vehicle insurance

- Agriculture and livestock insurance

- Riots and terrorism insurance

- Other types except travel, trekking, and health insurance

However, some reinsurance types are exempt from mandatory direct cession:

- Aviation insurance

- Riots and terrorism insurance (in some cases)

- Health, travel, and trekking insurance

3. Allocation of Direct Cession Ratios

The Directive also sets a gradual reduction in the mandatory direct cession percentage to each domestic reinsurer over time.

Allocation Schedule:

| Fiscal Year | Direct Cession to Each Domestic Reinsurer |

| Up to 2079/2080 (2022/2023) | 10% |

| 2080/2081 (2023/2024) | 8% |

| 2081/2082 (2024/2025) | 6% |

| 2082/2083 (2025/2026) | 4% |

| 2083/2084 (2026/2027) | 2% |

| 2084/2085 onward | No provision |

Enrollment Requirements for Foreign Reinsurers and Brokers

According to the Reinsurance Directive, any foreign reinsurer or foreign reinsurance broker who wants to provide reinsurance services to insurance companies in Nepal must first be enrolled with the Nepal Insurance Authority (NIA).

To get enrolled, they need to submit an application along with certain documents.

For foreign reinsurers, the required documents include:

- A copy of their license issued by the regulator in their home country.

- Their financial statements.

- Details of their portfolio and the type of business they plan to do with Nepali insurers.

- Information about their credit rating, including the name of the rating agency, the date the rating was received, and a copy of the rating certificate.

For foreign reinsurance brokers, the documents include:

- A copy of their license from the home country’s regulator.

- Their financial statements.

- Details of their portfolio and planned business in Nepal.

- A copy of their professional liability insurance policy.

Once all requirements are met, the NIA will enroll them for one year. After that, they must renew their enrollment every year to continue offering services.

Exceptions to the Enrollment Rule

Not all reinsurers and brokers need to enroll with the NIA. The directive gives exceptions for:

- Domestic insurers and domestic reinsurance brokers.

- Foreign reinsurers with top credit ratings from recognized agencies, such as:

- A++ rating from AM Best

- AAA rating from S&P

This means that highly rated international reinsurers do not have to go through the enrollment process before working with Nepali insurers

Role of Foreign Reinsurers

Foreign reinsurers play a crucial role in strengthening Nepal’s insurance market by providing access to global financial resources and advanced risk management expertise. They help Nepali insurers handle large or complex risks that may be beyond the capacity of domestic reinsurers alone. By partnering with reputable foreign reinsurers, Nepalese insurers can improve their financial stability, offer better protection to policyholders, and gain confidence from international investors. Moreover, foreign reinsurers introduce international best practices, technology, and innovation, which contribute to the overall growth and modernization of Nepal’s insurance industry. Encouraging healthy collaboration between domestic and foreign reinsurers ensures a balanced and resilient insurance ecosystem in Nepal.

Expanding Market Opportunities

Foreign reinsurers open doors to global insurance markets, helping Nepali insurers expand their reach and compete internationally. This global connection boosts the credibility of Nepal’s insurance sector and attracts foreign investment.

Risk Diversification and Stability

By working with foreign reinsurers, Nepali insurance companies can spread their risks more widely across different regions and markets. This diversification reduces the financial impact of large-scale disasters and helps maintain stability in the insurance system.

Access to Advanced Technology and Expertise

Foreign reinsurers often bring cutting-edge technology, analytics, and underwriting skills to Nepal’s insurance market. Their expertise helps local insurers better assess risks, price policies accurately, and design innovative insurance products tailored to customers’ needs.

Capacity Building and Training

Collaboration with foreign reinsurers creates opportunities for knowledge transfer and capacity building. Local insurers and professionals can learn new techniques and standards, raising the overall quality of services provided to policyholders.

Boosting Consumer Confidence

The involvement of well-known foreign reinsurers adds trust and confidence among consumers, assuring them that their policies are backed by financially strong and globally recognized entities. This trust encourages more people to participate in insurance, increasing market penetration.

Under Section 4, Requirement for Reinsurance:

Insurance companies in Nepal are required to manage risk responsibly. One of the key ways they do this is through reinsurance that is, by transferring some of their risk to another insurance company (called a reinsurer). This section 4 of the directive outlines the rules every insurer must follow when arranging reinsurance:

1. Mandatory Reinsurance Arrangement

If an insurance company cannot fully handle the risk itself or chooses not to keep all of the risk, it must arrange reinsurance for the portion it does not keep.

2. Conditions for Reinsurance

While arranging reinsurance, the insurer must follow these important rules:

- No gaps in coverage: All parts of the risk must be covered. The company must not leave any part of the insured risk uncovered, unless it is fully accepting that part itself.

- Diversify risk: The insurer should not depend on just one reinsurer. It must spread the risk among different reinsurers to reduce exposure.

- Analyze capacity: Before selecting a reinsurer, the insurer must check the technical expertise and financial strength of the reinsurer. This helps ensure they will be able to pay if a claim arises.

3. Don’t Issue Policy Without Reinsurance

An insurance company cannot issue an insurance policy unless it has made proper and adequate reinsurance arrangements for that policy.

4. Retain Some Risk

An insurer cannot reinsure 100% of the risk in every policy. It must retain a portion of the risk itself. This encourages responsibility and discourages over-reliance on reinsurance.

5. Adjusting Retention

Depending on the type and size of risk, an insurer is allowed to lower its net retention the amount of risk it keeps but it should not eliminate it entirely.

6. Priority to Domestic Reinsurers

If an insurer wants to do facultative reinsurance (a special type of reinsurance done case-by-case), it must first offer the deal to a Nepali reinsurer.

- That domestic reinsurer must respond within 24 hours.

- If they refuse or don’t respond in time, only then can the insurer look for a foreign reinsurer.

Choosing the Right Reinsurer

According to section 5, When an insurance company decides to transfer some of its risk to another company (called a reinsurer), it must carefully choose who that reinsurer is. This directive sets clear rules for selecting a qualified reinsurer:

- The insurer can only choose a Nepali reinsurer that is officially licensed by the Nepal Insurance Authority under the existing insurance laws.

- If the reinsurer is from another country, they must meet two conditions:

- They must be licensed by the insurance regulatory authority in their home country.

- They must be listed with the Nepal Insurance Authority as per Section 11 of this directive.

Determining Retention: Linking Risk to Capital

Under Section 6, net retention limits to the insurer’s net worth:

- Life insurers: Max 0.5% of net worth, capped at NPR 5 million.

- Non-life insurers: Max 5% of net worth.

- Foreign branch offices: May align with head office capacity.

Gradual Liberalization: Direct Cession Phase-Out

Section 7 presents a time-bound reduction in mandatory direct cession to domestic reinsurers:

| Fiscal Year | Minimum Direct Cession |

| 2079/80 | 10% |

| 2084/85 onwards | 0% |

Exemptions include high-risk categories like aviation and terrorism.

Implication: This calibrated approach allows domestic reinsurers to prepare for market competition while signaling future liberalization.

Mandatory Domestic Reinsurance for Priority Sectors

Per Section 8, insurers must reinsure 100% of certain sectors (life, motor, agriculture, livestock, riot/terrorism) within Nepal. Reinsurers cannot reject such allocations.

Facilitating Reinsurance of Overseas Property

Section 10 authorizes Nepali citizens to insure property/liability located abroad through licensed domestic insurers. Claims are settled in NPR.

Implication: This creates a new product opportunity for insurers, especially for migrant workers and overseas asset holders.

Listing of Foreign Reinsurers and Reinsurance Brokers

According to chapter 3 of the Reinsurance of Insurers Directive 2080 (2023 A.D.)

Section 11: Listing Requirements

Foreign reinsurers and reinsurance brokers who want to operate in Nepal must be officially listed with the Nepal Insurance Authority (NIA). To apply for listing, they need to submit an application along with specific documents.

For foreign reinsurers, the required documents include:

- A valid license issued by the regulatory authority in their home country, including license number and date of establishment.

- The name of the regulatory body that issued the license.

- Updated financial statements.

- Details of their business portfolio with insurers.

- Company information such as name, address, year of establishment, phone number, and email.

- Contact person’s name, address, email, and phone number.

- A power of attorney authorizing either an employee, representative, or a domestic insurer to act on their behalf for listing.

- Information about their rating agency, date of the latest rating, and a copy of the rating certificate.

For foreign reinsurance brokers, the documents required are similar:

- Valid license from their home country’s regulator with proof of validity.

- Name of the issuing regulatory body.

- Updated financial statements.

- Business portfolio with insurers.

- Company details (name, address, year established, contact information).

- Updated professional liability insurance certificate.

- Contact person details.

- Power of attorney granted to a local representative or insurer.

Once the application and documents are submitted, the Authority issues a listing number to the foreign reinsurer or broker.

Domestic reinsurers and brokers, as well as foreign reinsurers with top credit ratings (such as A++ from AM Best or AAA from S&P, Moody’s, or Fitch), do not need to be separately listed. However, insurers working with such highly rated reinsurers must certify this status.

If a reinsurance transaction arises mid-year with a new reinsurer or broker, they can apply for listing at that time.

Section 12: Renewal of Listing Number

Foreign reinsurers must renew their listing number with the Nepal Insurance Authority every year to remain active.

Section 13: Establishment of Office by Reinsurance Brokers

Any reinsurance broker receiving a listing number must establish a physical presence in Nepal—either a branch office, liaison office, or joint venture before the end of 14th January 2026.

Section 14: Conducting Business Transactions

Insurers in Nepal are required to conduct their reinsurance business only with domestic reinsurers and brokers or foreign reinsurers and brokers who hold a valid listing number from the Authority.

Section 15: Public Listing of Registered Entities

The Nepal Insurance Authority maintains a public list of all foreign reinsurers and reinsurance brokers who have obtained a valid listing number. This list is available on the Authority’s official website for transparency and reference.

Internal Reinsurance Policy Governance

Section 16 mandates every insurer to prepare and implement a reinsurance policy annually, including:

- Retention limits and risk segmentation;

- Reinsurer/broker selection criteria;

- Catastrophe risk plans and control systems.

Board approval and Authority notification are mandatory for any mid-year policy changes.

Implication: Reinsurance decision-making is institutionalized and tied to the insurer’s governance framework, limiting arbitrary practices.

Reinsurance Diversification Requirements

As per Section 18:

- Non-life insurers cannot allocate more than 60% of total reinsurance to a single reinsurer.

- The lead reinsurer may take up to 40%, followers up to 20% each.

- Exception: Life insurance, catastrophe reinsurance, and specific specialized risks (e.g., travel, clinical trial) may bypass this limit with Authority approval.

Catastrophe Reinsurance Obligations

Under Section 19–20, insurers must:

- Arrange catastrophe reinsurance for retained and excess liabilities;

- Maintain:

- Up to NPR 100 million net retention for life insurers;

- Up to 10% of net worth for non-life insurers;

- Define “geographical area” for probable maximum loss.

Mandatory Reinsurer Ratings

Section 21 sets minimum financial strength ratings:

- Treaty Lead Reinsurer: A-/A3/AAA

- Treaty Follower & Facultative Reinsurer: B/BBB/Baa1

Transitional Provision:

- Foreign reinsurers currently below threshold must be phased out within two fiscal years.

SAARC region reinsurers and domestic reinsurers are exempt under Section 22.

Reinsurance Brokers: Due Diligence and Licensing

Under Section 23–25:

- Brokers to be licensed either domestically or by a foreign regulator;

- Insurers to assess a broker’s track record, capacity, and reputation;

- Mandatory professional liability insurance.

Compliance, Monitoring, and Transparency

- Account Settlement: Must be done quarterly (Section 26).

- Internal Audit: Must include all types of reinsurance contracts (Section 29).

Section 29: Reinsurance Audit: Insurance companies are required to include reinsurance activities in their internal audit process. This means that all types of reinsurance agreements whether treaty, facultative, local facultative, or insurance pools must be reviewed and reported as part of the insurer’s quarterly or annual audit. This ensures transparency and proper monitoring of reinsurance transactions.

Section 30: Collective Insurance Fund (Insurance Pool) Arrangement

Sometimes, insurers may want to create a collective insurance fund or insurance pool to cover specific risks or insurance portfolios more effectively. To do this, they must apply to the Nepal Insurance Authority. If the Authority finds the proposal suitable, it can approve the formation of a domestic insurance or reinsurance pool.

Additionally, the Authority itself has the power to establish such a fund if deemed necessary. The management and operation of these funds will follow rules set by the Authority.

Section 31: Human Resource Development

Insurers must allocate adequate human resources in their reinsurance departments or branches. They are also responsible for conducting training and capacity-building programs for these staff members, helping ensure the workforce is skilled and knowledgeable about reinsurance.

Section 32: Data Submission

Insurers must submit detailed data and reports related to their reinsurance business to the Nepal Insurance Authority. This data must be provided within 15 days after the end of each quarter, using the format and system specified by the Authority. This requirement helps the Authority keep updated records and monitor the reinsurance market effectively.

Section 33: Reinsurance Sub-Committee

The Authority forms a special Reinsurance Sub-Committee composed of high-level officials from the Authority, representatives of life, non-life, and micro-insurers, as well as reinsurance experts. This committee advises on technical matters of reinsurance and evaluates the current status of reinsurance practices in Nepal.

Section 34: Power to Issue Directives

The Nepal Insurance Authority (NIA) has the power to issue directives to insurers to amend, modify, or cancel any reinsurance policy or related documents such as reinsurance treaties and cover notes submitted by insurers. This authority ensures that reinsurance arrangements comply with regulatory standards and can be updated as needed.

Section 35: Preservation of Records

Insurers must keep and preserve all records and documents related to reinsurance business and the implementation of this directive. Proper record-keeping is essential for accountability and regulatory inspections.

Section 36: Power of Interpretation

If there is any confusion or ambiguity in applying the provisions of this directive, the Nepal Insurance Authority holds the final power to interpret the rules.

Section 37: Repeal and Saving

This directive repeals the previous Insurer’s Reinsurance Directive, 2078 and any earlier related circulars or directives. However, all actions taken under the old directive are considered valid under these new directives.

Cover Notes: Submitted within 60 days for each treaty (Section 17).

- Data Submission: Within 15 days of quarter-end via the Authority’s system (Section 32).

- Reinsurance Sub-Committee: Established to oversee technical issues (Section 33).

Collective Insurance Pools and Regulatory Oversight

Section 30 allows the formation of collective insurance funds or pools for specific risks, subject to the Authority’s approval.

Section 34–35 empowers the Authority to:

- Amend insurer policies;

- Inspect documents;

- Interpret ambiguous provisions.

Repeal and Continuity

With the enactment of this directive, the earlier Reinsurance Directive, 2078 and related circulars stand repealed (Section 37), but previous actions remain valid under this directive.

Setting Up an Office by Reinsurance Brokers

If a reinsurance broker is registered with the Nepal Insurance Authority (NIA), they must set up an office in Nepal within six months of their registration.

They can choose one of these three ways:

- Joint Venture Company – Form a new company together with a local business or individual(s).

- Branch Office – Open a branch office of their existing company in Nepal.

- Liaison Office – Establish a liaison office to coordinate with clients and partners without engaging in direct business operations.

Diversification of Reinsurance

Insurance companies should not depend on a single reinsurer for most of their reinsurance needs. This is called diversifying the reinsurance portfolio, and it helps reduce risk.

For non-life insurance:

- An insurer can give no more than 60% of its total reinsurance business (or any single portfolio) to one reinsurer.

- The lead reinsurer can take up to 40% of the risk.

- The follower reinsurers can take up to 20% of the risk.

For life insurance, there is no such limit insurers can reinsure more than these percentages with a single reinsurer if they wish.

Exceptions to the Diversification Rule

In certain cases, one reinsurer may take more than the limits mentioned above. These exceptions include:

- Catastrophe reinsurance (for large-scale disaster risks)

- Facultative reinsurance (for specific, high-value risks)

- Special risk categories such as:

- International travel

- Trekking

- Clinical trials

- Professional indemnity

- Medical and health insurance

- Any other special reinsurance type approved by the NIA.

Conclusion

The Reinsurance Directive, 2023 represents a mature evolution of Nepal’s insurance regulation. It balances risk management, domestic protection, and international best practices. By fostering diversification, enforcing rating thresholds, and requiring policy governance, the directive enhances financial stability and positions Nepal’s insurance market for sustained, resilient growth.

It now falls on insurers, reinsurers, and brokers to align their practices with this framework and collaborate with the Authority to build a robust reinsurance ecosystem tailored to Nepal’s evolving economic and climate realities.

Top of Form